September 7th, 2025

NOTICE — IMPORTANT TERMS (READ BEFORE CONTINUING)

PUBLISHED: [09/07/2025]

POSITIONS: The author and/or Vintara Investing, its officers, directors, and/or their family members or affiliates may hold long or short positions in securities discussed in this Publication as of the publication timestamp above.

By accessing, reading, or otherwise using this article or email (the “Publication”), you acknowledge that you have read, understand, and expressly agree to be bound by the Terms, Conditions, and Disclosures attached to the end of this Publication under the section titled “Terms, Conditions, Disclosures, and Conflicts”, and by Vintara Investing’s full Disclosures & Conflicts page available at https://vintarainvesting.com/disclosures (collectively, the “Terms”). If you do not agree with any portion of the Terms, you must stop reading immediately and cease all use of this Publication.

You further acknowledge and agree that: (a) this Publication is provided for informational and educational purposes only and does not constitute investment, tax, legal, or accounting advice; (b) Vintara Investing does not provide individualized investment advice and does not owe you a fiduciary duty; (c) Vintara Investing and/or its contributors may own positions in securities discussed and such positions may change at any time; (d) you will not solicit personalized investment advice or portfolio recommendations from Vintara Investing concerning the content of this Publication — any such request will be declined and any response will be non-personal and will not create an adviser or fiduciary relationship; and (e) the Terms incorporate important liability limitations, indemnities, dispute-resolution procedures, and other legal provisions, which you accept by continuing to read.

For the full and controlling legal terms, including disclaimers, conflicts, limitations of liability, indemnification, and dispute-resolution provisions, see the attached Terms, Conditions, and Disclosures at the end of this Publication and the full Disclosures & Conflicts page at https://vintarainvesting.com/disclosures. Questions about the Terms may be emailed to [email protected] — do not use that address to request personalized investment advice; such requests will be handled in accordance with the Terms.

BY CONTINUING TO READ THIS PUBLICATION YOU CONFIRM THAT YOU HAVE READ, UNDERSTAND, AND AGREED TO BE BOUND BY THE TERMS, CONDITIONS, AND DISCLOSURES ATTACHED HERETO AND POSTED AT VINTARAINVESTING.COM/DISCLOSURES.

Rogers Communications RCI

September 7th, 2025

Last Price Fair Value Estimate Market Cap

$35.89 USD $60 USD $19.3B USD

Key Takeaways

CANADIAN TELECOMMUNICATIONS - Rogers Communications is the largest wireless service provider in Canada

HOLDINGS IN MAJOR LEAGUE SPORTS FRANCHISES - Large stakes in Canadian major league sports teams including the Toronto Raptors and Maple Leafs

UNDERVALUED AT CURRENT LEVELS - Considering cashflows and assets potentially overlooked by the market, Rogers Communications appears to trade at a discount. DCF models show serious potential upside.

SOLID MANAGEMENT/INSIDER ACTIVITY - Management currently focused on reducing debt. The company’s executive chair recently purchased nearly 1,000,000 shares.

ATTRACTIVE DIVIDEND PAYMENT - 4.12% paid annually.

Table of Contents

Business Overview

Investment Thesis

Financials and Margins

Valuation Analysis

Management

Technical Outlook

Risks

Catalysts

Appendix

Terms, Conditions, Disclosures, and Conflicts

Business Overview

Rogers Communications is a telecommunications and media company operating across Canada, offering wireless communications, cable television, internet, and security services to both residential and business customers. As a partner of Comcast, Rogers communications offers Comcast technology and branding in Canada including Rogers Xfinity. Additionally, Rogers owns various different media assets including a range of different regional T.V. channels, radio stations, and podcasts. Rogers Communications currently owns 75% of the Toronto Raptors, 75% of the Toronto Maple Leafs, 75% of Toronto FC, and 100% of the Toronto Blue Jays. The company is Canada’s largest wireless provider with over 30% market share.

Why We Like Rogers Communications

Dominant market position

Large holdings in major sports franchises

Positive capital allocation initiatives being implemented by management

Attractive valuation

We believe that Rogers Communications presents an attractive buying opportunity at the moment as it combines a dominant telecommunications business with major holdings in overlooked sports/media assets and strong free cash flows relative to its current valuation. We see Rogers Communications as two different businesses: a more typical communications company operating in cable T.V., internet, and wireless, and a holding company for Maple Leaf Sports and Entertainment assets that the market may be currently overlooking. Additionally, management has recently put significant focus on reducing debt, a critical step forward that we believe has the potential to drive serious upside.

Financials and margins

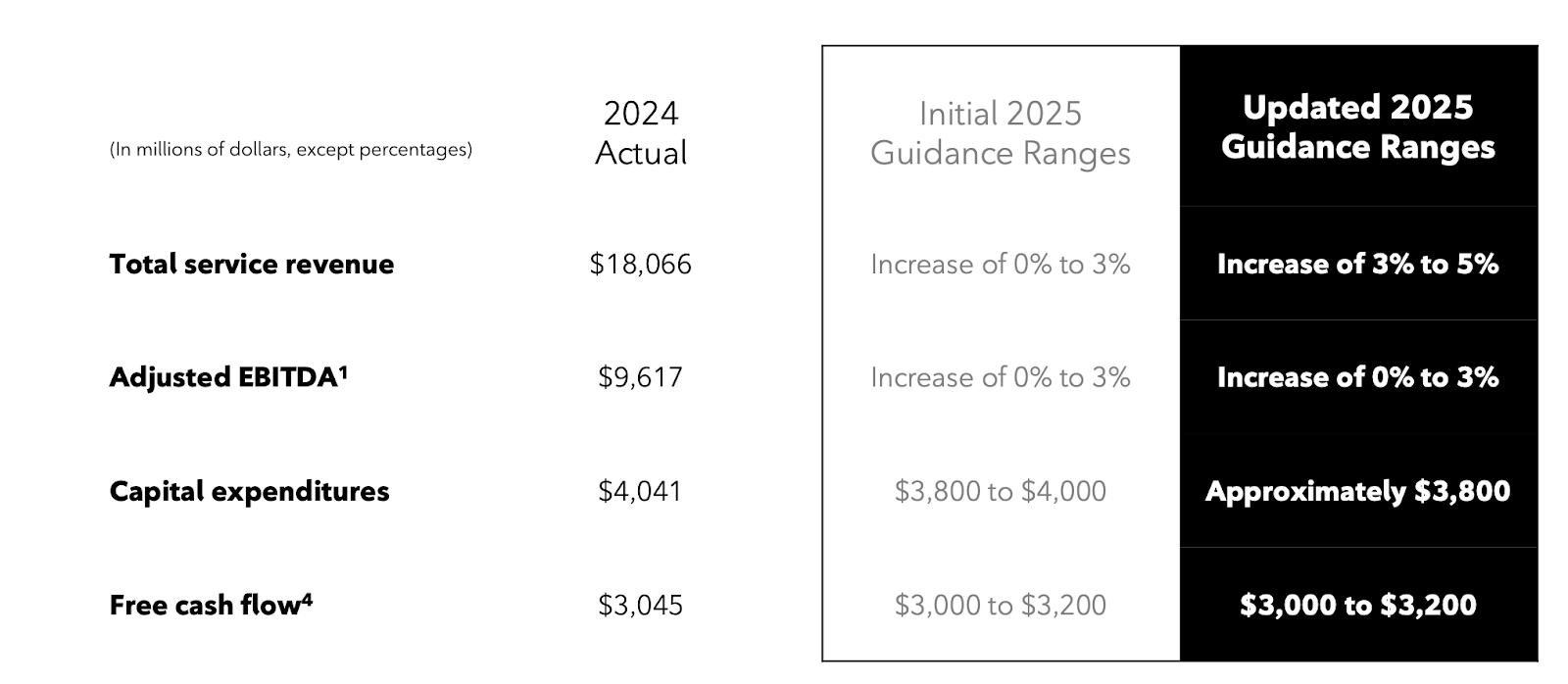

(All numbers in the above table are in CAD)

In 2024, Rogers Communications saw $18.1 billion CAD or $13.1 billion USD in revenue, $9.6 billion CAD or $7 billion USD in EBITDA, capital expenditures of $4 billion CAD or $2.9 billion USD, and free cash flow of $3 billion CAD or $2.2 billion USD. This means an EBITDA margin of 53.23% and a free cashflow conversion rate of 31.64%. Their 2025 guidance includes revenue growth of 3-5%, EBITDA growth of 0-3%, capital expenditures of $3.8 billion CAD or $2.7 billion USD, and free cash flow of $3-3.2 billion CAD or $2.17-$2.3 billion USD.

In 2024, Rogers Communications had a gross margin of about 47%, an operating margin of about 24%, and a net margin of about 8%. These are seen as fairly typical when compared to other telecom companies both within Canada and the states. A comparison of these margins is seen below including Rogers Communications (NYSE:RCI), BCE Inc (NYSE:BCE), Telus Corporation (NYSE:TU), Quebecor Inc (TSX: QBR-B.TO), AT&T (NYSE:T), and Verizon (NYSE:VZ).

Looking at their balance sheet, Rogers Communications has $6.96 Billion CAD or $5 Billion USD in cash and $42.45 billion CAD or $30.7 billion USD in debt. This equates to an enterprise value of about $45.1 billion USD. This debt currently has a weighted average interest rate of 4.79% and an average term to maturity of 10.2 years. Much of this is the result of their large, debt funded acquisition of Shaw Communications in 2023.

Valuation Analysis

Rogers Communications currently owns 75% of the Toronto Raptors, 75% of the Toronto Maple Leafs, 75% of Toronto FC, and 100% of the Toronto Blue Jays. The company paid $3.5 Billion USD for 37.5% of Maple Leaf Sports and Entertainment, the company that owns these franchises, upping their share to 75% in a deal announced in September of 2024 and closed in July of 2025. This means that Rogers communications is invested in all of these franchises, and the major venues where these teams play, at a valuation of about $9.3 billion USD.

Sports franchises are currently often valued irrationally, selling for inflated prices and being treated less like a business/investment and more like a trophy symbol for billionaires, think high end art, mega yachts, or luxury real estate. Incredibly wealthy individuals are paying high prices for these franchises just for the sake of owning them, being less concerned with their valuation and ROI. In addition to purchases from individual billionaires, private equity has been investing heavily in sports. As Trump has just opened the door to private equity investments in retirement accounts, an increase in interest and capital could be seen directed towards these alternative investments, bringing more high valuations to sports franchises.

Recently, the Los Angeles Lakers sold for 10 Billion USD, the Boston Celtics sold for 6.1 Billion USD, the Washington Commanders sold for 6.05 Billion USD, the Dallas Mavericks sold for 3.5 Billion USD, and the Charlotte Hornets sold for 3 Billion USD. While hard to estimate their precise value due to the nature of the market for sports franchises, it is entirely possible that the market is failing to account for the likely inflated value of the sports franchises owned by Rogers Communications. This is seen as after the record high sale of the Lakers, Madison Square Garden Sports (MSGS), which owns the New York Knicks and the New York Islanders, jumped about 7% to account for the increase in perceived value of major league sports teams, while Rogers Communications stock did not move significantly. Rogers Communication has the ability to possibly sell equity in their teams for high prices or employ their management to better monetize these assets and generate cash to reduce debt, or possibly invest further in their other operations.

While less significant, Rogers communications also owns 75% of the Toronto Argonauts, Toronto’s professional American football team in the Canadian football league, through their stake in Maple Leaf Sports and Entertainment. Viewership and interest in American Football in Canada has been steadily growing as the NFL has been attempting to grow in international markets. While not clear, it is possible that Rogers Communication’s stake in this team could be a potential modest upside driver in the coming years if Canadian interest in American football continues to grow.

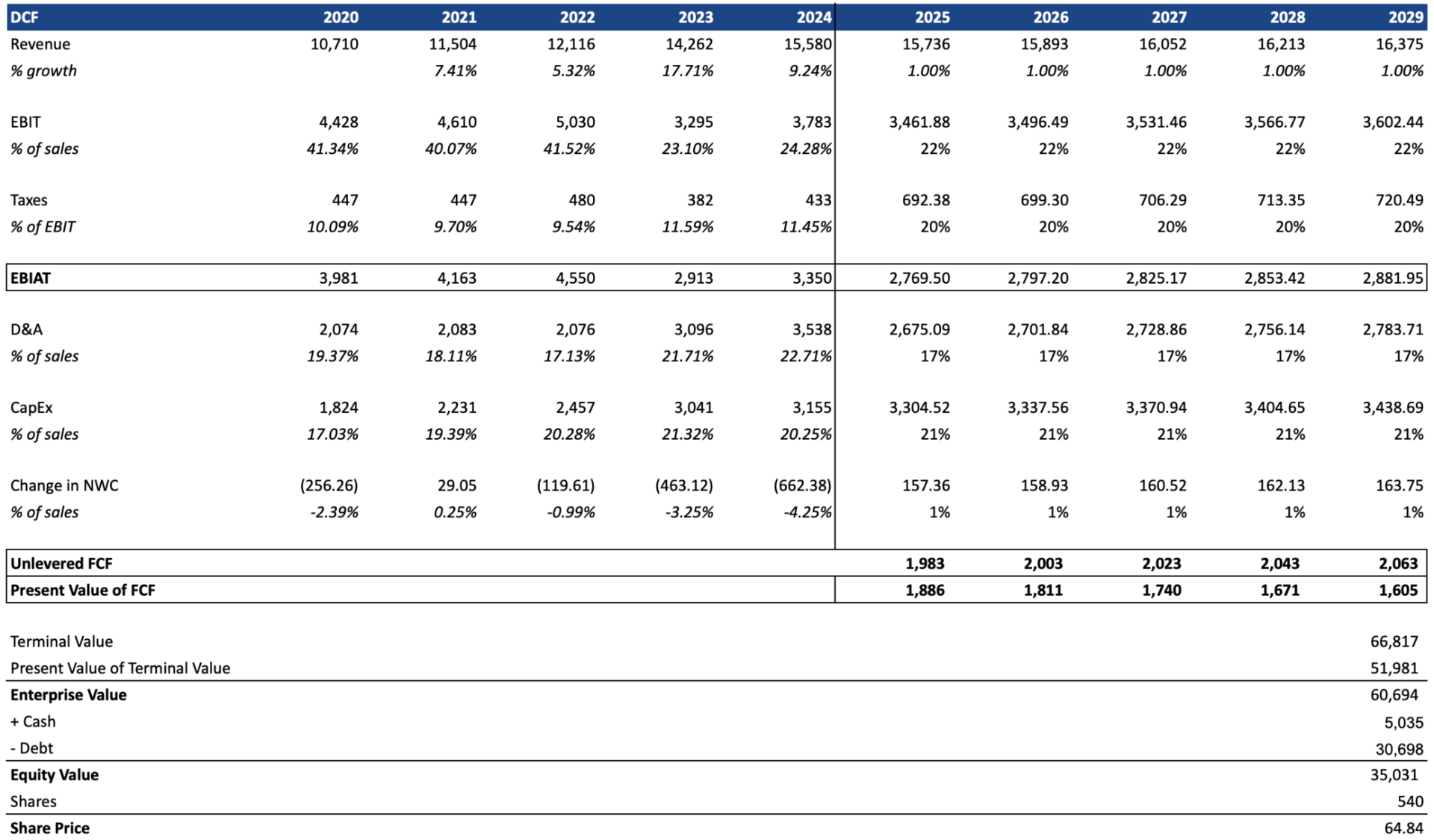

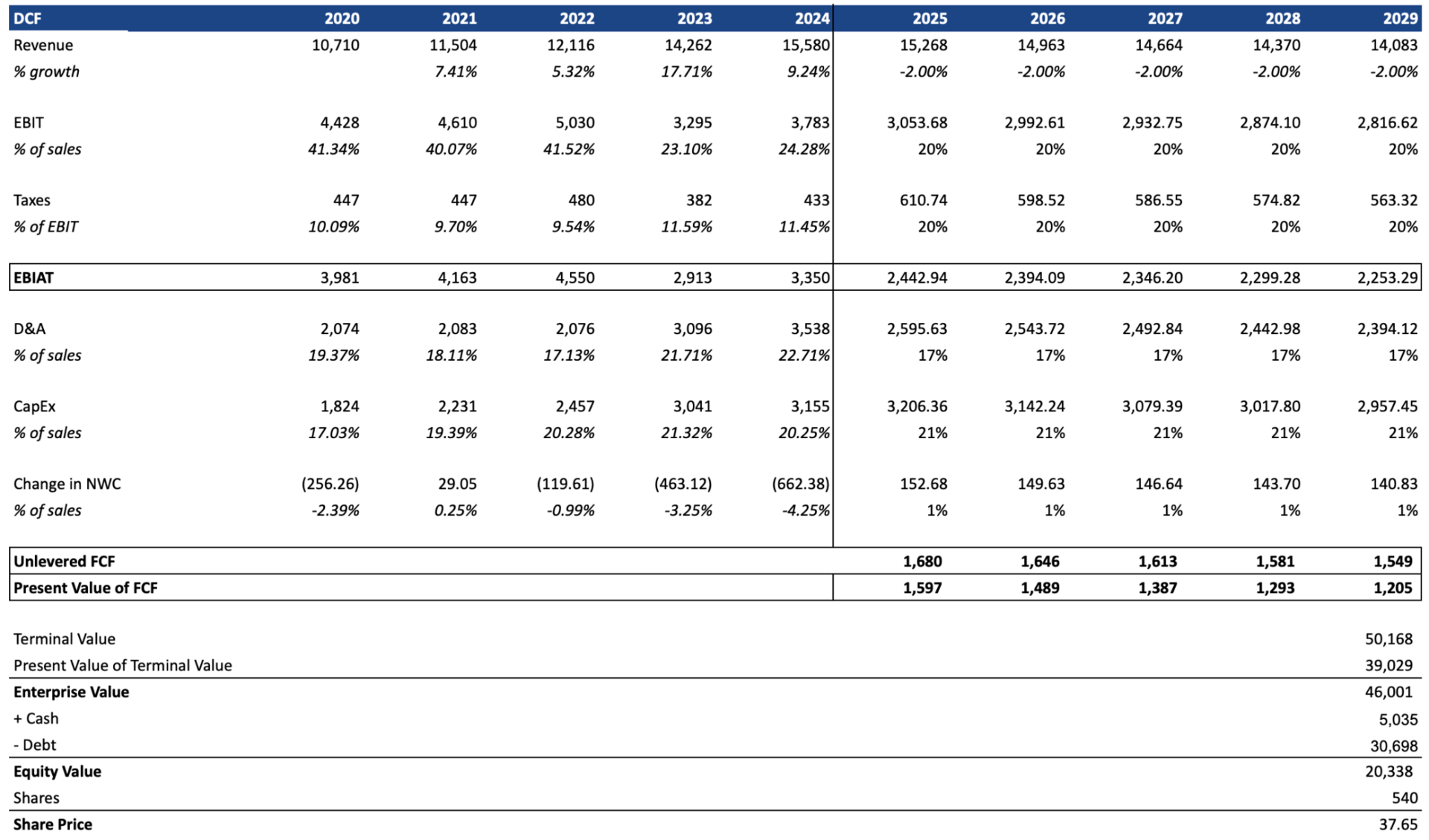

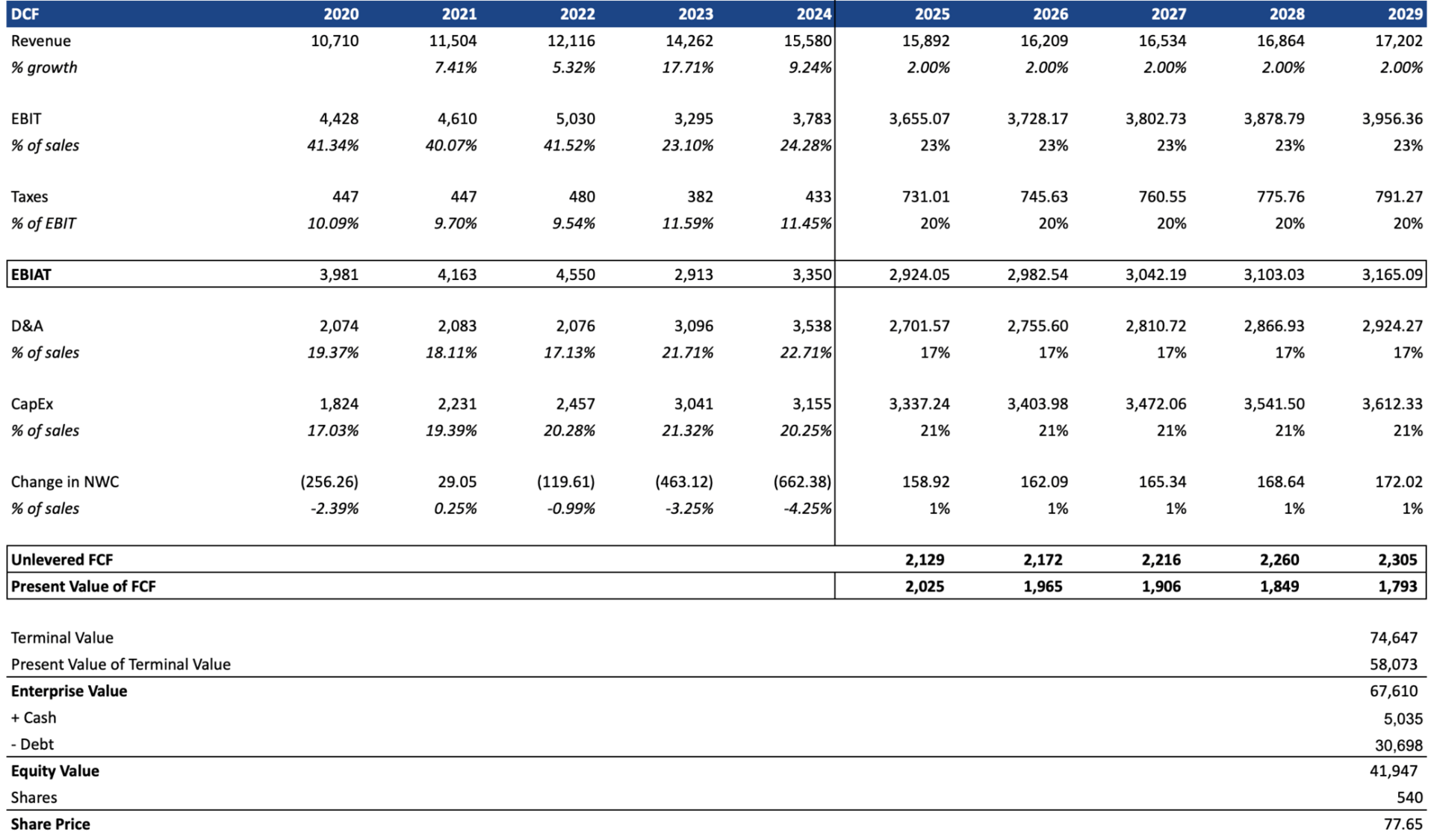

Building out discounted cash flow models for Rogers Communications, assuming a weighted average cost of capital of 5.15% and a terminal growth rate of 2%, a base case share price of $64.84 (+80.7%) is seen, a bear case share price of $37.65 is seen (+4.9%), and a bull case share price of $77.65 (+116.3%) is seen. While these models are far from perfect and consist of just estimates and projections, this still indicates serious upside. Refer to the models in the appendix to see all assumptions and estimates used.

Rogers Communications has a price to earnings ratio of 14.78, an enterprise value to EBITDA ratio of 6.54, and an enterprise value to revenue ratio of 3.45. A comparison of these ratios to the ratios of comparable stocks is attached below. A price to earnings ratio of 27.21 is seen when averaging the price to earnings ratios of Rogers Communications and comparable stocks. Applying this multiple to Rogers Communications which had earnings per share of $2.43 USD in 2024, a share price of about $66 is seen. A EV/EBITDA ratio of 7.99 is seen when averaging the EV/EBITDA ratios of Rogers Communications and comparable stocks. Applying this multiple to Rogers communications, which had an EBITDA of $6.9 billion USD in 2024, an enterprise value of $55 billion USD is seen. Accounting for cash, debt, and share count, an enterprise value of $55 billion USD means a share price of about $54. An enterprise value to revenue ratio of 2.01 is seen when averaging the enterprise value to revenue ratio of Rogers Communications and comparable stocks. Applying this to Rogers Communications, which had 2024 revenues of $13 billion USD, means an enterprise value of $13.6 billion USD which equates to a share price of about $25.

Management

Rogers Communications currently has debts of $30.7 billion USD. This is not ideal and means that it is unlikely for a share buyback program any time soon. However, instead of an equity buy back, Rogers Communications is engaging in a debt buy back program in order to better their capital structure and reduce their interest expenses. The company offered bond holders cash tender offers, prioritizing higher cost long term debt. Announced in July of 2025, a total of $2.77 billion USD in tender offers were received. We see this as a positive decision from management and something necessary to improve capital allocation.

In addition, management is currently selling non-core assets of the business with the intent of using the proceeds from these sales to repay debt. Most recently, in August of 2025, the company announced an agreement with InfraRed Capital Partners to sell nine Rogers business data centers. We see an initiative like this as a major positive as it is management taking direct action to reduce debt.

Looking at insider buying, in the last three months 950,000 shares were purchased entirely by Edward Rogers, the executive chair of Rogers communications. His average cost was $48.23 CAD or about $34.97 USD. Over the last 12 months, a total of 977,881 shares were purchased, including those bought by Edward Rogers. Only 937 shares have been sold by insiders in the last 12 months.

A dividend of 0.37 USD is paid quarterly, working out to about 4.12% annually given their current stock price of $35.89 USD. The next record date is September 8th, 2025 and it will be paid out on October 3rd, 2025. The dividend is supported by cash flows and quite enticing to those looking for higher dividend paying stock.

Technicals

RCI presents an opportunistic technical situation that gives positive context to a decision to buy when paired with the fundamental situation previously described. The three year weekly chart shows the emergence of an uptrend in the second quarter of this year, following a multi-year long down trend. It also indicates, by the green, horizontal line, a strong resistance around $36. The one year, daily chart also indicates a support around $35, providing a potential range of consolidation going into the future. Momentum is also shown by the 20 period simple moving average holding a higher value than the 50 period simple moving average. These factors all reinforce the buy status of RCI and provide guidelines for future decision making. Over the next few weeks, it will be important to keep an eye out for movement around the $36 USD mark, action above this level will be a good indicator of positive market sentiment.

3 year, weekly chart:

1 year, daily chart:

Risks

We believe that potential risks for Rogers Communications include but are not limited to:

Failure to successfully further monetize Maple Leaf Sports and Entertainment quickly

Cyber security issues and network outages

A weakened Canadian dollar

Increased competitive pressure leading to loss in market share

Poor market pricing for assets like their data centers that they may be looking to sell

Rising interest rates or refinancing pressure

Regulatory or political pressure

Catalysts

We believe that potential catalysts for an increase in Rogers Communications stock price could include but are not limited to:

Improved monetization or sales of Maple Leaf Sports and Entertainment assets

More sales of non-core assets

Increased debt buybacks

Any new initiatives introduced by management to help pay back debt

Operational beats including market share gains or improved margins

Lower interest rates that would allow for refinancing of debt

Key catalyst:

Continued focus on and successful balance sheet deleveraging/debt reduction

Ultimately, proceeds from the sale of different assets or increased income and cash flows will likely be used by management to repay debt. Successful execution of this is what will crystallize value.

Appendix

DCF models:

Base case:

Bear case:

Bull case:

Terms, Conditions, Disclosures, and Conflicts

Effective Date: [August 27, 2025]

These Terms, Conditions, Disclosures, and Conflicts (these “Terms”) are effective as of the Effective Date above. These Terms explain the material terms, disclaimers, and disclosures that apply to content and services provided by Vintara Investing (collectively “Vintara Investing,” “Vintara,” “we,” “us,” “our”, or “publisher”) through vintarainvesting.com (the “Website”), the client portal at app.vintarainvesting.com (the “Client Portal”), email newsletters and messages distributed from [email protected], reports, premium content, and other communications (collectively, the “Materials”). By accessing or using the Website, the Client Portal, emails from [email protected], reports, or other Materials, you agree to these Terms. If you do not agree, do not access or use the Materials.

1. No Investment Advice

1.1 The Materials are provided for informational and educational purposes only and do NOT constitute investment, financial, tax, legal, or accounting advice, nor a recommendation, offer, or solicitation to buy or sell any security.

1.2 Nothing in the Materials creates a fiduciary, advisory, broker, or professional relationship between you and Vintara Investing, its affiliates, officers, directors, employees, or contributors (collectively, “we,” “us,” or “Publisher”). If you require individualized or personalized advice, consult a licensed professional.

1.3 No Reliance. You acknowledge that you will not rely on the Materials as a substitute for your own research, judgment, or for advice from a qualified professional.

2. Forward‑Looking Statements & Accuracy

2.1 This Publication may contain forward‑looking statements, estimates, projections, and opinions. All such statements are inherently uncertain and subject to change without notice.

2.2 While we use commercially reasonable efforts to provide accurate and up-to-date information, Vintara Investing does not guarantee the accuracy, completeness, or timeliness of any data, analysis, or opinions contained in the Materials. All information is subject to change without notice.

3. Conflicts of Interest & Ownership Disclosure

3.1 The Publisher, its writers, principals, and/or their family members or affiliates may own long or short positions in securities discussed in the Materials. Such positions may be established, increased, reduced, or closed at any time and without notice.

3.2 We may receive compensation directly or indirectly in connection with the publication of certain content (including sponsored content, affiliate arrangements, referral fees, or other commercial relationships). Paid or sponsored content will be clearly labeled where applicable.

3.3 Positions Timestamp; No Public Holdings Register. Each Publication will include a publication timestamp and a one-line position disclosure stating that positions may exist and the time as of which positions were current. We do not maintain a public, author-by-author holdings register; readers should assume positions may exist unless a Publication expressly states otherwise.

4. No Requests for Personalized Investment Advice; Declination Policy; Non-Creation of Adviser Relationship

4.1 You must not solicit or request personalized investment advice, portfolio recommendations, trading instructions, or tailored financial planning from the Publisher, its employees, contributors, or representatives regarding the contents of the Material or any security discussed herein.

4.2 All such requests will be declined. If you nonetheless submit a request for personalized advice via email, the client portal, or any other channel, the Publisher’s sole obligations shall be to (a) transmit a written refusal to provide personalized investment advice and (b) at the Publisher’s option provide only generic, non-personal informational responses (for example, factual clarifications). The Publisher expressly reserves the right to ignore, delete, or refuse to respond to requests that seek personalized investment advice.

4.3 Any response by the Publisher to an inquiry shall be informational only, shall not be tailored to your individual circumstances, and shall not create a fiduciary, advisory, or other professional relationship between you and the Publisher. Do not rely on such communications as personalized advice.

5. No Solicitation & Third‑Party Links

5.1 This Publication is not a solicitation or offer to buy or sell any security.

5.2 We may link to third-party websites or content. We do not control, endorse, or guarantee the accuracy, completeness, or timeliness of any content on third-party sites and are not responsible for their privacy practices or terms. Your use of third-party sites is at your own risk.

6. Indemnification

6.1 To the fullest extent permitted by applicable law, you agree to indemnify, defend, and hold harmless Vintara Investing, its officers, directors, employees, agents, affiliates, and contributors from and against any and all losses, liabilities, damages, claims, costs, and expenses (including reasonable attorneys’ fees) arising out of or relating to: (a) your breach of these Terms; (b) your misuse of the Materials; (c) your reliance on or use of any information contained in the Materials; or (d) any third-party claim arising from your action or inaction based on the Materials. This indemnity shall survive termination of any subscription or access to the Materials.

7. Limitation of Liability

7.1 To the fullest extent permitted by applicable law, IN NO EVENT shall Vintara Investing or its officers, directors, employees, agents, affiliates, or contributors be liable for any direct, indirect, incidental, special, consequential, exemplary, or punitive damages (including lost profits, trading losses, or loss of data) arising out of or related to the Materials, your access to or use of the Materials, or reliance on any information contained in the Materials, even if advised of the possibility of such damages.

7.2 You assume all risk associated with any investment decision based on the Materials.

8. Notice; Opportunity to Cure

8.1 Before initiating any arbitration or litigation arising out of or relating to the Materials, you agree to provide Vintara Investing with written notice of the claim at [email protected] describing the nature of the claim, the facts on which it is based, and the relief sought. Vintara Investing shall have sixty (60) days from receipt of such notice to investigate and, if reasonably practicable, cure or propose a resolution. If the parties cannot resolve the dispute within that period, you may pursue the remedies available to you under these Terms.

9. Monetary Cap

9.1 To the fullest extent permitted by applicable law, the aggregate liability of Vintara Investing and its affiliates arising out of or relating to these Materials shall not exceed the greater of: (a) the subscription fees actually paid by you to Vintara Investing in the twelve (12) months preceding the claim; or (b) USD $1,000. This cap shall not apply to liability arising from fraud, willful misconduct, or any liability that cannot be limited by applicable law.

10. Corrections, Updates & Archiving

10.1 If we discover a material error in published Materials, we will publish a correction and timestamp it on the Website and, where practicable, in the client portal. Because emails cannot be edited after distribution, corrections to emailed materials will be posted and timestamped on the Website and/or in the client portal and may be referenced in a subsequent communication or subsequent email issue.

10.2 Archiving. We will retain archived copies of Publications and corrections for a commercially reasonable period and, upon reasonable request, will provide copies to subscribers or regulators as required by law.

11. No Warranty

11.1 The Materials are provided “AS IS” and “AS AVAILABLE,” with all faults and without warranty of any kind, express or implied, including but not limited to warranties of merchantability, fitness for a particular purpose, accuracy, completeness, non-infringement, or uninterrupted availability.

12. Changes & Amendments

12.1 We may update or revise these Terms at any time. The Effective Date at the top reflects when the current version takes effect. For material changes affecting subscriber rights or legal remedies, we will provide notice in a prominent manner (for example, via email and a prominent website notice). Continued access to or use of the Materials after the Effective Date constitutes acceptance of the revised Terms.

13. Governing Law & Dispute Resolution

13.1 These Terms shall be governed by and construed in accordance with the laws of the State of Illinois, without regard to conflict-of-law principles.

13.2 Except where prohibited by applicable law, any dispute, claim, or controversy arising out of or relating to these Terms or the Materials shall be resolved by binding arbitration administered by the American Arbitration Association (AAA) under its Consumer Arbitration Rules (or JAMS at Vintara Investing’s election). The arbitration will be conducted in Cook County, Illinois (remote proceedings permitted).

13.3 YOU AND VINTARA INVESTING EACH WAIVE ANY RIGHT TO A JURY TRIAL AND AGREE TO BRING CLAIMS ONLY ON AN INDIVIDUAL BASIS; CLASS, COLLECTIVE, AND REPRESENTATIVE ACTIONS ARE WAIVED TO THE EXTENT PERMITTED BY LAW.

13.4 If arbitration is prohibited by applicable law with respect to any particular claim, the parties agree that the state and federal courts located in Cook County, Illinois shall have exclusive jurisdiction over that claim.

13.5 The notice and cure requirement in Section 8 must be satisfied before initiating arbitration or court litigation.

14. Statute of Limitations

14.1 To the fullest extent permitted by law, any claim or cause of action arising out of or relating to these Terms or the Materials must be brought within one (1) year after the claim arises, or it will be forever barred. (Please consult counsel regarding enforceability in your jurisdiction.)

15. Severability

15.1 If any provision of these terms is found invalid or unenforceable, such provision will be struck and the remaining provisions will remain in full force and effect.

16. Incorporation of Full Disclosures & Conflicts; Contact

16.1 By continuing to access or read this Publication you expressly acknowledge that you have read, understand, and agree to be bound by Vintara Investing’s full Disclosures & Conflicts page, which supplements and is incorporated by reference into these Terms. The full Disclosures & Conflicts page is available at: https://vintarainvesting.com/disclosures.

16.2 Contact & Legal Notices. Official editorial distributions and notices are sent from [email protected]. For customer inquiries, corrections, privacy requests, or other general matters contact: [email protected]. Legal notices and claims must be sent to [email protected] and are subject to the notice and cure requirement in Section 8.

17. Third-Party Processors & Privacy

17.1 We use third-party service providers (including, without limitation, Beehiiv for subscription management and newsletter delivery, email/analytics providers, hosting providers, and payment processors). These processors may transfer and process personal data in the United States and other countries. For details on categories of data collected, processing purposes, retention, transfer safeguards, and how to exercise data subject rights, see our Privacy Policy: https://vintarainvesting.com/privacy.

Survival

The provisions of Sections 3, 4, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, and 17 (as renumbered above) and any other provisions that by their nature should survive termination shall survive any expiration or termination of these Terms.

By accessing or using the Website, the Client Portal, emails from [email protected], reports, or other Materials, you acknowledge that you have read, understood, and agree to be bound by these Terms, Conditions, Disclosures, and Conflicts.